american working in canada taxes

You should know the Canadian tax year is the same as the US. Whats it like for.

Canadians May Pay More Taxes Than Americans But There S A Catch

If an individual is present in.

. Employees working remotely in Canada may become tax residents of Canada and be subject to Canadian tax on their worldwide income. Residents to work in Canada should ensure that Canadian withholding taxes are deducted and remitted to Canada. There are major tax consequences that will directly affect you espe.

But this works only for employees working in the short duration of 90 days or less in a year. Under both countries tax laws you may be obliged to file personal income tax returns for each. This form works as a tax exemption form for all American employees engaged to work in Canada.

Such as embassies and. If you are an American citizen living in Canada your tax situation is delicate. Canadian tax residency can occur.

On his Canadian earnings. Tax year starts January 1 and ends December 31. Tax year but the filing deadline is different.

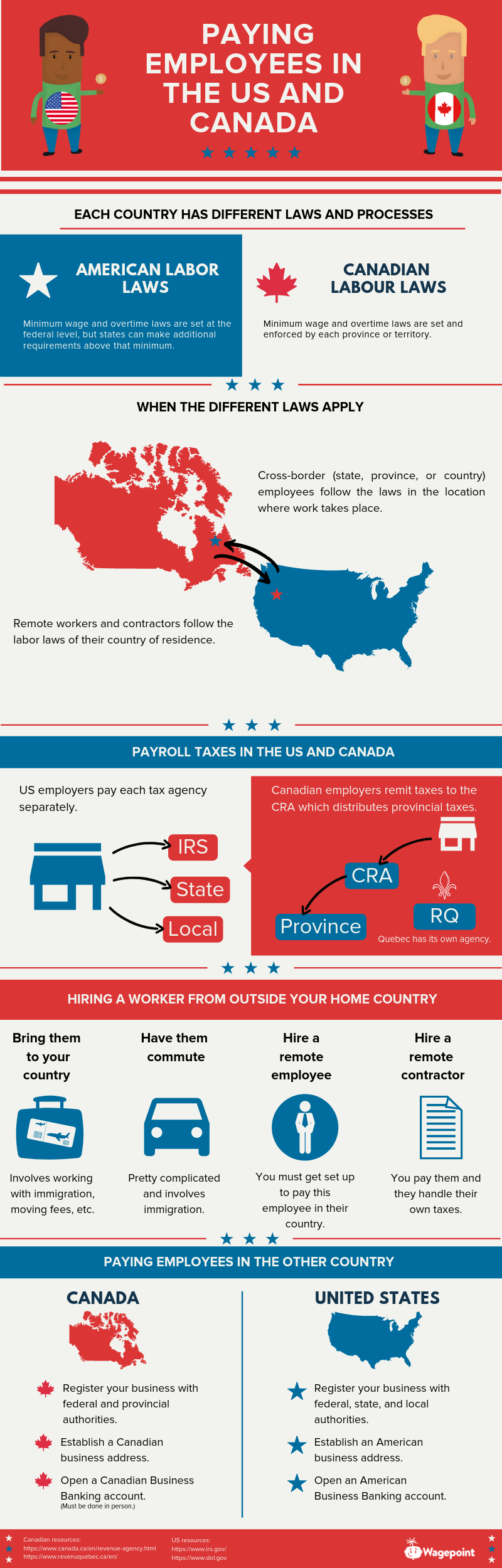

Bases taxation on both your residence and citizenship status. The Canadian equivalent of the IRS is called the CRA Canada Revenue Agency and the personal income tax declaration form is called T1 General or just T1. Under Article XV of the Canada US Tax Treaty a US resident could be potentially subject to Canadian tax on the salary earned from a US employer.

Employer with a fixed base in Canada who hires or transfers US. Tax return every year regardless of where they live or work. E Generally if a US person CitizenGreen CardResident for tax purposes has earnings from a foreign source including working for foreign govt.

This means American citizens must file a US. But theres a treaty agreement between the two countries that exempts an expat American citizen working in Canada from being taxed by the US. An American employee that is not a Canadian tax resident under Canadian law is required to only pay taxes on certain Canadian income.

If youre an American working in Canada it is very important that you watch this video. Canadian taxes follow a.

Move To Canada From The Us Immigration Work Study Visa Options Canadavisa Com

Tax Assesment For U S Citizens Working In Canada Tax Consultants In Toronto

Canada U S Hold National Celebrations This Week As Well As Share Many Tax Similarities Don T Mess With Taxes

Us Expat Taxes For Americans Living In Canada Bright Tax

Americans In Canada Tax Implications You Need To Be Aware Of Crowe Soberman Llp

The U S Canada Tax Treaty Explained H R Block

6 3 Explanation And Interpretation Of Article Vi Under U S Law Canada U S Tax Treaty Tax Professionals Member Article By The Accounting And Tax

Sales Taxes In The United States Wikipedia

5 Tips For Us Citizens Working In Canada Expat Tax Professionals

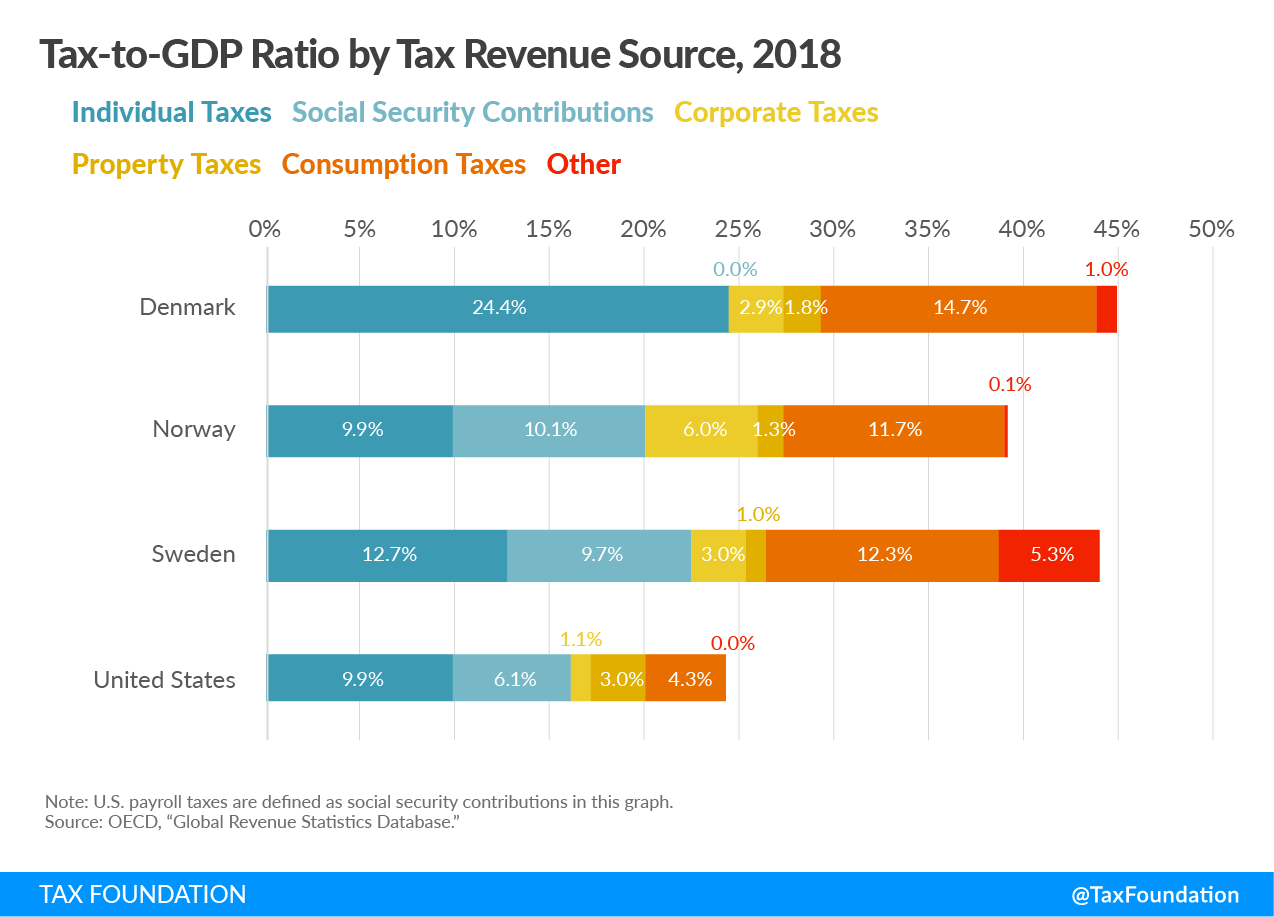

How Scandinavian Countries Pay For Their Government Spending

Americans Working In Canada And Taxes

Guide To U S Expat Taxes In Canada H R Block

Sources Of Us Tax Revenue By Tax Type Tax Foundation

Self Employment Tax For U S Citizens Abroad

What Are The Consequences Of The New Us International Tax System Tax Policy Center

Taxes And Financial Reporting For American Pro Athletes In Canada Far North Sider

Obligations Of American Citizens Living In Canada Effisca

Tax Filing For Dual Citizens Cross Border Tax Us Tax Law Firm

Paying Employees In Canada And The Us What You Need To Know Smallbizclub